When I started consolidating the reported waste and recycling facility fires in 2016, I was realistic that the first few years would drive the baseline data defining the scope of the problem, providing us with a basic understanding of the consequences and finding and evaluating the effectiveness of solutions available to address the problem. Now that we have officially completed year five, it is time to take the next step. So, instead of reporting January’s reported fire incident data, I have decided to wait until March to release both January and February’s reported facility fires.

This month, I am going to focus on some of the insights and highlights I am learning as I put together 2020’s Annual Report, which will identify trends and include fire prevention best practices and solutions.

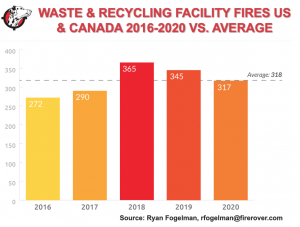

According to the data, 2020 was an average year. We experienced 317 reported fire incidents in our waste and recycling facilities, which is slightly lower than the average number of 318. So, why does 2020 seem anything but average?

In a nutshell, 2020 was atypical. We saw a gradual increase in fire incidents from March to June along with a virtual cliff in July and August where our typical summertime spike did an about-face with the lowest numbers ever. Then in October and November, we experienced the highest rate of fire incidents we had faced since 2016.

In 2020, the waste and recycling industry experienced 317 reported facility fires in the U.S. and Canada. Additionally, we incurred 23 reported injuries and three deaths that can either be directly or indirectly attributed to these fire incidents. Based on reasonable assumptions, we can extrapolate that 1,800-plus facility fires have occurred during that time, which, based on the number of facilities reported by the Environmental Research & Education Foundation (EREF), is more than 40 percent of the industry. I define “reported facility fires” as any fire that has been reported by the media that occurs at a waste or recycling facility in the U.S. and Canada.

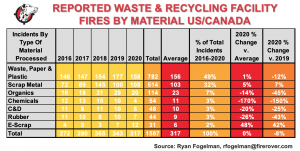

Evaluation of Fire Incidents Based on Material Type

If you read last year’s Annual Report, you know that I was not comfortable with the material “buckets” I had been using in my reporting. Simply put, fires that were occurring at paper and plastic recycling facilities were not properly represented due to media reports and the fact that I had a hard time knowing which materials actually caused a fire. Because of this, I believe it makes sense to include all waste, paper and plastic fire incidents in one bucket. This bucket makes up the materials recovery facilities (MRF) and transfer station operations across the U.S. and Canada. The major distinction in the material is that these are traditionally the channels where hazards like lithium-ion batteries, chemicals and gasoline and propone tanks are improperly placed into the waste and recycling stream. These reported fires are down 12 percent year-over-year.

I had also been placing construction and demolition (C&D), scrap metal and e-scrap into another bucket but found that C&D operations have been historically underrepresented by the media as they often share facilities with other recycling operations. After a year of using this bucket, I have concluded to keep scrap metal, e-scrap and C&D separated. While it is true that they all share a similar pattern where their material has risks that can be alleviated on the front end, each of these occupancies has unique aspects that have led me to this decision.

Decrease in Waste, Paper and Plastic Fires: Municipal solid waste (MSW), paper and plastic recycling fires decreased in 2020 but are still in line with the five-year average. This occupancy has been the hardest hit from the wave of lithium-ion (Li-ion) batteries that are improperly placed into the waste and recycling stream.

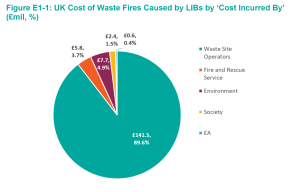

This issue is a global issue and its cost to the industry was recently outlined in a report based on research conducted by Eunomia Consulting across the pond. According to the report, this problem is only set to get worse, with more and more Li-ion batteries placed onto the market each year. Of the 670 fires recorded by ESA waste management members across the UK in 2019-2020, 38 percent were either recorded as caused by Li-ion batteries or “suspected” to have been. This is higher than the percentages recorded in the previous three years by the body (21 percent in 2016-2017, 25 percent in 2017-2018 and 22 percent in 2018-2019).

The positive news is that those that have focused on safety, proper fire prevention planning and investments in technology solutions have experienced less fires. The survey results by Eunomia outline its recommended best practices for risk reduction to the industry, such as getting lithium-ion batteries out of the waste stream through education, fines, deposit programs and more, but it does not single out technology innovations like Fire Rover, which has proven to be key to mitigating these risks in the U.S.

The real problem in both the UK and the U.S. is that the cost for these fire incidents is unfairly borne by the operators. Producers get off scot-free in this equation where they manufacture these batteries, distribute them across the board and leave the operators, fire professionals and society to deal with their problems.

Eunomia has estimated the real cost of lithium-ion battery fires in the UK to be about £158 million. If we use the same assumptions I use in my reasonable assumption for unreported fire incidents and take into account the current exchange rate, the cost to the U.S. and Canada due to lithium-ion battery fires is unfairly more than US$1.2 billion. Since Eunomia’s study only blamed lithium-ion batteries for about 50 percent of fires, which is in line with past U.S. surveys, the real cost borne by our waste and recycling operators is realistically and conservatively about US$2.5 billion annually.

Our solution of best practices and investments in technology is working. How do we know this is the case? Insurance companies have noticed. In 2018, insurance companies couldn’t leave our occupancy fast enough. Since that time, we have been gradually gaining options for the best operators. I have personally fought and won favorable outcomes by proving that our customers who have developed operational best practices, in combination with having our early thermal detection and fire elimination solution in place, have less fire risk than any point in history, which includes the time before the lithium-ion battery wave even began.

Increase in Scrap Metal Fires: In 2020, scrap metal fires started to increase from their large drop in 2019 or, depending on your interpretation, their huge spike in 2018. My belief is that if you take out 2019, we are on an upward trend that will continue, especially since there were a couple of big months in 2020 like September when fires at scrap metal facilities were the highest ever.

How is the scrap industry responding? It has spent a ton of time and effort on implementing “best practices” developed by traditional industry fire experts, but in my opinion, this occupancy could benefit the most from investment in new fire technology and evaluation and recommendations from fire experts outside of the space.

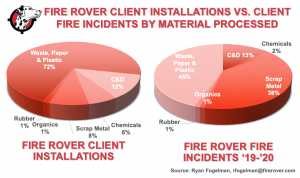

Take a look at the latest numbers from fire incidents we have detected and eliminated at our clients’ operations in the past two years. As you can see, scrap metal fire incidents account for 38 percent of our total fire incidents even though they account for only 8 percent of our client installations. However, these are great operators that understand that they need to invest in proven technologies to help them mitigate their specific risks. The truth is that insurance companies are willing to provide policies to all types of high fire-prone industries. Insurance companies only leave when they feel that the risks are not able to be controlled or there is no end in sight.

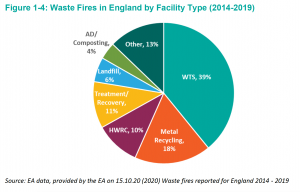

Looking at England’s data provided in Eunomia’s report, only 18 percent of its fires occur at metal recycling operations. This data looks at all waste fires, not just fires caused by lithium-ion batteries. According to my data, scrap metal fire incidents make up 32 percent of all reported fires in the U.S. and Canada; 34 percent if you include e-scrap fire incidents. In the same data, waste, paper and plastic fires make up 49 percent of all fires. If you add HWRC (household waste recycling center) and WTS (waste transfer station) in England, the number accounts for 49 percent of all reported fires.

After seeing this data, the question we must ask is why are the scrap metal operators in the U.S. experiencing almost double the number of fires incidents than in England?

There is no easy answer to this question, but I can confidently state that any of the scrap operators that have added our technology to their operational best practices have not had a major or catastrophic fire incident while our solution has been in place. Only time will tell whether the fire prevention planning strategy that the Institute of Scrap Recycling Industries has developed and rolled out to its members is enough to stem the tide of these fires alone, or if the investment in technologies will be required in the future.

C&D Fire Incidents are Underrepresented: C&D fire incidents were down from 10 to 8, or 25 percent, year-over-year. This number has remained consistent, and I believe that there is some ignorance from reporters who tell the story of “recycling fires” and share the material that caused the fires, so I would say this number is unrepresented. Additionally, a number of MRFs are hybrid and able to accept C&D materials as well as MSW. There also isn’t a true list of C&D operators that I know of, and in my opinion, the number of C&D outfits is growing. I personally know of five new facilities opening in 2020 and most industry insiders would say the same. The operations do have fires, but a large number have invested in the proper technology and processes to detect and eliminate these fires early. Another benefit is that C&D operations are typically located further distances from the public, which has a direct effect on whether a fire gets reported by the media.

The Burgeoning E-scrap Market: A new concern I have been tracking is fire hazard incidents with an e-scrap specialty. Recycling personal electronics and personal storage is in its infancy from a historical perspective. The public push to recycle these materials has two very positive effects: (1) less personal storage and/or electronics get into our waste and single stream recycling, and (2) we are able to better recycle and reuse all of the components including rare earth metals we so desperately need. The issue is that anyone with pliers and a garage can hang a shingle and claim to recycle electronics. There are some great operators out there, but the process is custom and different than RMA (return merchandise authorization) programs, which have been in existence for years and allow a specific manufacturer to control how it disassembles and reuses or disposes of its products’ components, specifically batteries.

Recycling general electronics comes with many different processes, such as for disassembly and removal of lithium-ion batteries in products, and unfortunately, operators performing this very necessary function for society are often left to hold the bag with most of the risk and cost of fire dangers.

Conclusion

As I continue to work through this year’s data, as well as other data that I have been able to get my hands on, I’m starting to see patterns that need responses from a number of places, not just operators. We need the producers of these hazards, whether lithium-ion or traditional hazards, to get some skin in the game and take responsibility for what happens with their products when they continue down the supply chain. We need individuals and the public as a whole to continue to recycle right while teaching others to do the same. We need more investments in innovative solutions and technologies that deal with our issues in unimaginable ways. We need an industry that isn’t afraid to fight our battles and hold those parties responsible, at least monetarily paying their share of public education, sharing operational best practices and investing in new technologies that put us further and faster down the path of solving our fire issues.

If you would like a PDF copy of the “2020 Reported Waste & Recycling Facility Fires Annual Report” when it is published, please contact me directly or visit https://share.hsforms.com/1BfbGLhtpQMaVg2Haf73tqg4ljm3.